When Growth Moves Faster Than Liquidity, Confidence Breaks

Revenue growth is the number most companies celebrate. But when it runs ahead of liquidity, that celebration can be short-lived.

Across Australia’s mid-market and SME sector, a familiar pattern is emerging. Businesses are reporting strong sales while quietly running into cash strain. Orders rise, invoices grow, but liquidity tightens. The problem isn’t profit, it’s rhythm.

Growth changes the tempo of a business. It accelerates decisions, increases commitments and stretches timing across payroll, suppliers and customers. When finance systems can’t keep up with that speed, confidence in the numbers begins to fracture.

The quiet erosion of confidence

When growth outpaces liquidity, the first sign of trouble isn’t insolvency. It’s uncertainty. Forecasts lose accuracy. Budgets stop reflecting what is really happening. Leaders begin to sense that the financial story no longer matches the operational reality.

At CFOPartners, we see this often. The numbers look healthy, yet the team no longer trusts them. The issue isn’t incompetence or neglect. It’s that the business is moving faster than its systems can translate.

“When finance systems fall behind the pace of growth, confidence breaks long before cash does.”

Finance functions built for accuracy rather than adaptability struggle to keep rhythm with an organisation in motion. They can close the books, but not predict the next turn. That’s when decisions start to drift from data to instinct and confidence begins to break down.

Liquidity is more about timing than cash

Liquidity problems rarely start with a shortage of money. They start with timing.

As growth accelerates, cash conversion slows. Customers take longer to pay, inventory builds, or new hires increase costs ahead of receipts.

A company can appear profitable while becoming steadily less liquid. Traditional reports won’t show it until it’s late. They capture events after the fact. But liquidity moves continuously, shaped by behaviour rather than ledger entries.

Liquidity reflects timing, not just totals — and timing is a human variable.

Every delay, a late invoice, a shipment held up, a budget approval deferred, changes the rhythm of the business. When these small lags compound, they distort the view of performance. What looked sustainable on a spreadsheet starts to feel unstable in reality.

How investors see it differently

Private-equity and venture-capital investors approach growth from a different angle. They assume forecasts will be wrong in detail but right in rhythm. Their confidence doesn’t come from perfect prediction; it comes from testing timing.

Before deploying capital, investors stress-test the liquidity cycle: how quickly sales become cash, how long it stays tied up, and what happens under pressure. They manage timing as carefully as profit.

Mid-market leaders can learn from that discipline. Building investor-grade forecasting doesn’t require more software or headcount. It requires a shift in mindset. Finance has to move from recording what happened to interpreting how the business behaves.

The human side of cash flow

Liquidity is as behavioural as it is financial. It reflects how people act under pressure — when customers pay, how teams approve spending, how leaders manage competing priorities.

A ten-day payment delay might seem small until it happens across 200 customers. A decision to overstock ahead of a seasonal spike might feel prudent but ties up capital that could fund growth elsewhere.

Small behavioural shifts create big liquidity effects. The best CFOs measure both.

These micro-decisions aggregate into liquidity behaviour. Yet most board packs focus on static metrics, not on the human timing behind them. When those rhythms aren’t visible, liquidity issues appear as surprises rather than patterns.

Technology helps, but rhythm matters more

Finance technology has made reporting faster, not necessarily smarter. Dashboards can show numbers in real time, but they can’t interpret what they mean. Automation without rhythm simply speeds up the production of confusion.

The best use of technology is to shorten the feedback loop between operations and finance. Data should move at the same pace as the business. But interpretation, the ability to understand behaviour, still depends on people.

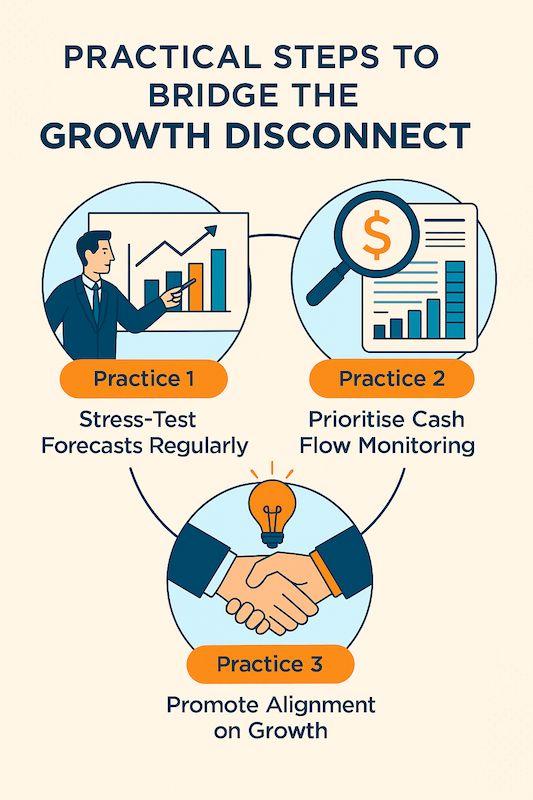

Three practices that restore rhythm between ambition and cash flow.

Rebuilding rhythm between ambition and cash

Restoring confidence starts with seeing liquidity as a system in motion. Three practices make the biggest difference.

1. Shorten feedback loops

Move from monthly to rolling forecasts. Integrate weekly cash reviews into leadership discussions. Small timing issues can then be corrected before they compound.

2. Connect data with behaviour

Identify what drives changes in timing, sales incentives, payment terms, project delays, procurement cycles. Understand why cash flow is moving, not just how much.

3. Model scenarios, not single outcomes

Replace static budgets with range-based forecasts. Test the impact of slower payments or higher costs. Confidence comes from being prepared for variability.

When finance and operations share that rhythm, forecasts become more credible. The discussion shifts from explaining surprises to managing performance.

Culture defines confidence

Ultimately, liquidity rhythm is cultural. In mature organisations, finance isn’t the department that closes the books; it’s the function that keeps time.

The CFO’s role is to translate ambition into liquidity, ensuring the business has the capacity to grow without losing stability. That requires collaboration across leadership, not just control from finance.

Confidence is built daily, through rhythm shared between finance and operations.

When leaders share a common rhythm, they act with confidence. When they don’t, uncertainty spreads.

A different economic cycle

The past decade of cheap capital allowed many businesses to grow without mastering liquidity discipline. Rising interest rates have now exposed that gap.

Access to credit is slower. Suppliers are less flexible. Customers are more cautious. Timing matters again.

For finance leaders, this cycle is a return to fundamentals. Businesses that understand their liquidity behaviourally, as a pattern to manage rather than a number to report, will find themselves steadier through volatility.

The real measure of resilience

The future of finance will not be about speed; it will be about rhythm. Reports will become more automated, but confidence will still depend on alignment between ambition, liquidity and timing.

When growth moves faster than liquidity, confidence breaks. When rhythm is restored, growth becomes sustainable again.